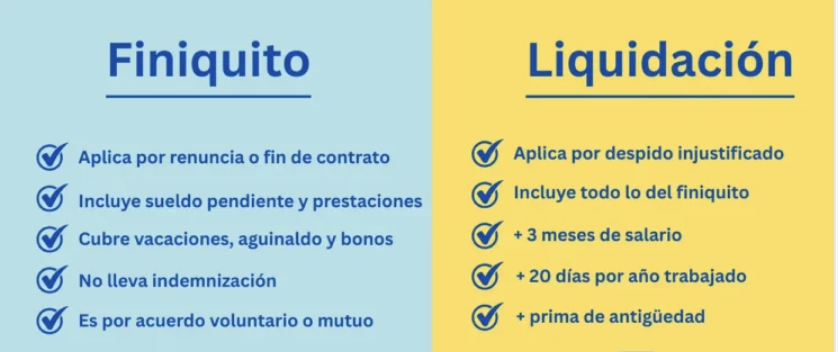

Why it matters to distinguish severance (liquidación) and final paycheck (finiquito) in 2025

As a labor attorney, I see the same maneuver every day: “you don’t qualify for severance, only the final paycheck,” plus a paper to sign “in agreement.” If you sign without reviewing, you can lose tens of thousands of pesos. Here I explain, plainly, what each one is, how it’s calculated in 2025, and the legal path to claim every peso you’re entitled to.

What a final paycheck (finiquito) is and when it applies

When a finiquito is due

A finiquito applies when the employment relationship ends without employer liability (resignation, mutual agreement, true expiration of a fixed-term contract, or dismissal with proven cause).

Legal basis and nature

It is payment of accrued and proportional benefits; it does not include compensation for unjustified dismissal.

What the finiquito does include

Unpaid wages, proportional year-end bonus (aguinaldo), proportional vacation pay and vacation premium, and other regular agreed benefits. In certain cases, seniority premium (prima de antigüedad).

How to calculate the finiquito in 3 steps

Step 1: unpaid wages

Daily wage × days worked and not yet paid.

Step 2: proportional year-end bonus

(Integrated daily salary × 15 ÷ 365) × days worked in the year.

Step 3: vacation and vacation premium

[Vacation days by seniority × (days worked ÷ 365)] × daily wage + 25% vacation premium.

Quick finiquito example

Example data

Integrated daily salary (SDI): $500.00

Days worked in the year: 240

Days worked and unpaid (last half-month): 6

Annual vacation days you’re entitled to: 8

Vacation premium: 25%

Step-by-step calculation

Unpaid wages: 500.00 × 6 = 3,000.00

Proportional year-end bonus: (500.00 × 15 ÷ 365) × 240 = 4,931.51

Proportional vacation:

Proportional days: 8 × (240 ÷ 365) = 5.26 days

Vacation pay: 5.26 × 500.00 = 2,630.00

Vacation premium 25%: 2,630.00 × 0.25 = 657.50

Total vacation: 2,630.00 + 657.50 = 3,287.50

Estimated total finiquito: 3,000.00 + 4,931.51 + 3,287.50 = 11,219.01

What severance (liquidación) is and when it applies

Unjustified dismissal and related situations

It applies if you’re dismissed without proven legal cause, if you’re pressured to resign, or if alleged causes are not substantiated.

Severance components

Three months of integrated salary, 20 days per year of service, seniority premium (12 days/year, capped at 2 daily UMAs unless your salary is lower), back wages/updates; plus the finiquito items (proportionals).

Practical severance formula with numbers

Illustrative calculation

Example data:

Integrated daily salary (SDI): $600.00

Seniority: 4.25 years

Estimated daily UMA: $108.57

Calculations:

Three months: 600.00 × 30 × 3 = 54,000.00

20 days per year: 600.00 × 20 × 4.25 = 51,000.00

Seniority premium:

Days by seniority: 12 × 4.25 = 51 days

Applicable cap: min(600.00, 2 × 108.57 = 217.14) = 217.14

Amount: 51 × 217.14 = 11,104.14

Severance subtotal: 54,000.00 + 51,000.00 + 11,104.14 = 116,104.14

Add the finiquito proportionals (year-end bonus, vacation, unpaid wages) and, if applicable, updated back wages until payment.

How to tell your case in practice

Quick checklist

You were asked to sign a “voluntary resignation” to release payment and you didn’t want to leave → likely disguised dismissal (severance).

“Staff reduction” without proven individual cause or offer of reinstatement → severance.

Fixed-term contract renewed many times for the same ongoing position → possible sham (severance).

Real, documented serious misconduct with correct procedure → finiquito.

Resignation by personal decision, without pressure → finiquito.

Legal deadlines you can’t miss

Action windows

Severance (unjustified dismissal): 2 months to sue from the dismissal date.

Finiquito and other accrued benefits: 1 year.

Recommendation: start mandatory conciliation immediately; if no agreement, sue with the certificate of non-conciliation.

Costly mistakes to avoid

What to avoid

Signing “in agreement” without review (write “received, not in agreement” and keep a copy), accepting “bonuses” instead of severance, missing deadlines, and failing to keep evidence (pay stubs, bank statements, emails, chats, witnesses).

How to present convincing numbers in conciliation

Practical method

Determine your SDI (base + average of regular variables over 3–12 months ÷ 30), build two scenarios (finiquito vs severance) with a line-item breakdown, attach evidence (payroll, contract, policies, commission reports, dismissal communications), and request full payment in writing.

Attorney’s conclusion

Coming in with clean calculations and solid evidence is the difference between accepting “what there is” and collecting what you’re owed. If it’s a finiquito, demand every proportional; if it’s severance, claim full compensation and don’t sign under pressure. Act quickly: conciliation, certificate, and, if needed, a lawsuit. For a professional review before signing, visit abogadomex.mx and find a labor attorney near you.